George Osborne made a speech today about the economy. Overnight, it had been trailed by briefings that he would announce plans to make government surpluses legally binding, and the need to cut another £25bn after the election. This is what I was planning to blog about, but having sought out the full text of his speech (read it here), it’s just not worth it. Instead I thought I’d just pick out a few Coalition phrases that in a sane world would be banned. Osborne’s speech is littered with them. Why not leave your own favourite in the comments below.

1. ” …the world does not owe Britain a living.”

Eh? Who is arguing it does? Meaningless. Explain yourself Mr Osborne.

2. “What is true of this company [Seetec] is true of our country.”

Really? So a government should behave exactly like a private business?

3. “The plan is working.”

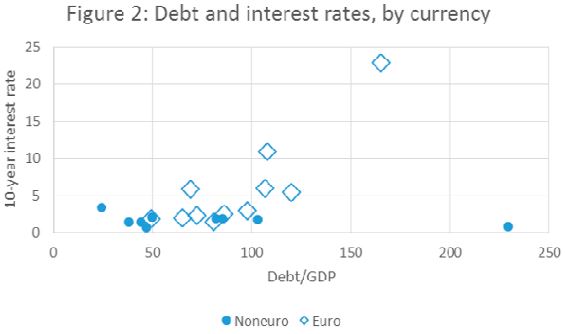

This is the Tory Party’s mantra now, but “the plan” was junked a long time ago. Remember, they wanted to eliminate the deficit by 2015 and have the debt/GDP ratio falling by the election. It was stupid and counterproductive, but that was the plan.

4. “Our long term economic plan has five key parts to it. The first is to go on reducing the deficit so we deal with our debts – because that’s the way to safeguard our economy for the long term and keep mortgage rates low.”

It seems to me that if there is a relationship between the government’s deficit and mortgage rates, it precisely the opposite to the one the Chancellor wants us to believe. When the deficit falls and the economy recovers, mortgage rates will go up.

5. “…Britain was borrowing more than £400 million every single day to pay for government spending.”

Was it? Or was it saving £400 million more than it was investing every day?

6. “The only way to improve people’s living standards for the long term is for Britain to earn its way in the world…”

Earn its way in the world. Like “the world does not owe Britain a living” this stupid phrase promotes the lie that exports are the only way to salvation. And yet our trade deficit remains.

7. “…people who work hard and want to get on…”

Just typing that phrase was painful.

8. “A strong economy and a fair economy go hand in hand.”

But we will get neither.

9. “We have to make sure the recovery supports those who work hard and play by the rules.”

But not you, dole scum.

10. “…benefits as a lifestyle choice.”

Millions living the life of Riley off your taxes!

11. “The long term unemployed are no longer going to get something for nothing.”

Think community service, but for people who have broken no laws.

12. “Reducing taxes for hardworking people.”

By hardworking he means “earns over £100k per year”.

Basically then, Osborne thinks we are worthless, ignorant fools who will believe any old shit while he goes about his business cutting taxes and regulation to benefit his mates. Don’t let him get away with it, but also don’t expect a Labour Government to be much better. Their rhetoric may be less harsh, but the substance is almost identical.